The Housing Boom and Bust

I just finished reading Stanford economist Thomas Sowell‘s new book, The Housing Boom and Bust. It’s a really easy read, not too technical, but filled with a lot of good statistics. The thesis of the book can basically be summed up by the following paragraph:

In a complex story about intricate financial arrangements, it is possible to lose sight of a plain and fundamental fact – that behind all the esoteric securities and sophisticated financial dealings are simple, monthly mortgage payments from millions of home buyers across the country. When many of those payments stop coming, no amount of financial expertise in Wall Street or government regulatory intervention from Washington can save the whole investment structure built up on the foundation of those mortgage payments.

The bedrock question then is: Why did so many monthly mortgage payments stop coming? And the bedrock answer is: Because mortgage loans were made to more people whose prospects of repaying them were less than in the past. Nor was this simply a matter of misjudgment by banks and other lenders. The political pressures to meet arbitrary lending quotas, set by officials with the power of economic life and death over banks and over Fannie Mae and Freddie Mac, led to riskier lending practices than in the past.”

I wish Sowell wrote more about the effect of credit default swaps and other complex financial derivatives, but he pretty much dismisses those as “downstream effects”, while the real cause of the crisis was that people were living in homes they couldn’t afford, due to the political pressures on banks and regulators to lend or allow lending to those people, in the name of “affordable housing”.

Sowell also raises an interesting argument that I haven’t heard before. He says that the boom in real estate prices was really a local issue, and that most communities across the country did not see prices rise much more than inflation and incomes. In localities such as coastal California, Miami, Phoenix, Las Vegas, etc. land use restrictions were put in place to limit the land available for building homes. For example, in bubble areas such as San Mateo County in California, more than half of all land is designated as “open space” and cannot be developed. In places like Houston and Dallas, which have no such restrictions and which have seen incomes rise faster than the national average, there was no housing bubble. He argues that such land use restrictions are often put in place by wealthy elites in the name of environmental friendliness, smart planning, or protecting the community from urban sprawl. It has the secondary effect of artificially raising the home values for the people that already live in the community. Furthermore, he argues that these restrictions are unconstitutional, as it allows people to restrict building on land (the “open spaces”) that they do not own.

Sowell also leaves us with this discouraging statement regarding President Obama and his various economic interventions:

Whatever its shortcomings economically, what government job creation programs can do politically is create a large class of people beholden to the government and likely to vote for those who gave them jobs in hard times. The political success of the New Deal is beyond dispute. That FDR could be re-elected in a landslide in 1936 and re-elected again to an unprecedented third term in 1940, despite never having gotten unemployment down into single digits during his first two terms, is a sign that President Obama may also be able to succeed politically, even if his policies turn out to be an economic disaster for the country as a whole.”

June 7, 2009 4 Comments

An Interesting Consequence of Regulation

Milton Friedman once said that regulations favor big businesses and put small businesses at a disadvantage. The theory goes that big businesses can afford the lawyers, accountants, and staff to manage complex regulations, as well as the lobbyists to influence regulators and other government bureaucrats, while small businesses and fledgling companies cannot. It should therefore be the case, that in the most heavily regulated industries, you will see some of the largest and most powerful companies.

Of course, large companies sometimes have advantages in other ways (industries with high startup costs, economies of scale, etc.) And also some might say that the regulations are put in place because the companies became too large. Nevertheless, it’s interesting to look at a list of the largest companies in 2008 (by revenue) in the U.S., and to see what industries they represent:

- Wal-Mart – Retail

- ExxonMobil – Energy/Oil

- Chevron – Energy/Oil

- General Motors – Automobiles

- ConocoPhillips – Energy/Oil

- General Electric – Congolmerate

- Ford Motor – Automobiles

- Citigroup – Banking

- Bank of America – Banking

- AT&T – Telecommunications

So in the top 10 we have companies representing banking, energy/oil, the auto industry, and telecom. Though I haven’t proved anything, I don’t think it’s a coincidence that these are some of the most heavily regulated industries in the country.

Another way of looking at is to look at the age of companies. The idea is that regulations would give the advantage to older, more entrenched corporations. That’s exactly what Brian Gongol has done. His data shows that corporations in countries with heavy regulations tend to be much older. Again, correlation doesn’t imply causation, but the data is interesting nonetheless.

So next time someone suggests that government somehow needs to restrain the size of banks, auto companies, or pharmaceutical companies, so that they don’t become too big (to fail) and powerful, think for a second that the reason those companies are so large may due to government involvement in the first place.

May 20, 2009 No Comments

When Less is More

In the wake of the collapse of Lehman Brothers and Merrill Lynch, both presidential candidates are calling for tighter regulation of the U.S. financial markets. That might make for good soundbites, but it’s more important to look back at the root cause of today’s troubles.

Under Presidents Bill Clinton and George W. Bush, the government heavily promoted home ownership to all citizens, even those with lower incomes and weak credit. Fannie Mae and Freddie Mac bought these loans from the primary lenders (banks) because they offered the highest rate of return, and coincidentally, the most risk. Fannie and Freddie casually assumed those risks, because the two companies were effectively guaranteed by the federal government, i.e., the taxpayer.

Whose idea was it to create Fannie Mae? It was part of Franklin Roosevelt’s New Deal administration. Who’s idea was it to make Fannie Mae a private corporation with implicit government backing? It was Lyndon Johnson’s (Freddie Mac was created in 1970 during Richard Nixon’s administration to provide some competition to Fannie Mae). Whose jobs were to make sure that Fannie and Freddie were able to handle these high-risk mortgages? The regulators. Why didn’t the regulators do their jobs? It might be that the incentive for someone to do his/her job as a regulator is much less than the incentive for someone else to try to make millions of dollars. The end result is that the seeds sown by the government years ago probably set the stage for the takedown of two huge financial companies, and possibly more to come.

I think what we can learn from all this is that when the government intervenes in the free market, any short-term benefit will likely be counteracted by an unforeseen catastrophe in the long-term. What’s happening now is probably a much needed correction in the financial markets that will be necessary for long-term economic health. Hopefully, the government doesn’t throw too many wrenches in the works during the meantime.

September 15, 2008 No Comments

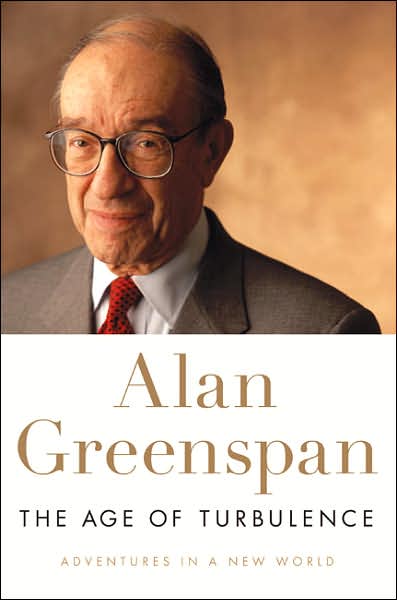

A Future of Turbulence

So here’s my first somewhat serious blog post. I’ve just finished a great book called The Age of Turbulence, written by former Federal Reserve Chairman Alan Greenspan. The first half of the book is essentially a chronological story of his life and career, including his stint as Federal Reserve Chairman from 1987 to 2006. All told he worked for seven presidents in some economic leadership role, and the insight and stories he shares from working in those administrations is absolutely fascinating. The second half of the book is more devoted to his views on economic policy and the challenges that the United States faces as a result of globalization, rising energy and health care costs, and the continued threat of terrorism.

I certainly share Alan Greenspan’s libertarian economic views and his belief that the country needs to maintain as much of a free-market society as possible if we want to look forward to continued economic prosperity. I was definitely reading this book with an eye on the upcoming presidential election. It seems that if we want to put and end to our economic woes we will need to elect the candidate who will do the following:

- Embrace globalization. If we elect a candidate who favors trade barriers or government assistance to protect and U.S. manufacturing jobs lost in the short-term, we will become less competitive in a global market in the long-term, and our economic standing in the world will fade.

- Exercise fiscal restraint. The U.S. federal budget in 2008 was $2.9 trillion. Of this, the mandatory budget items in order were Social Security ($608 billion – 21%), Medicare ($386 billion – 13%), Unemployment/Welfare ($324 billion – 11%), Interest on the National Debt ($261 billion – 9%), and Medicaid + SCHIP ($209 billion – 7%). As for discretionary spending, the Department of Defense leads ($481 billion – 12%). Included partly in this number are the wars in Iraq and Afghanistan ($190 billion – 7%). The entitlement programs account for 52% of government spending and are set to increase as more baby boomers hit retirement age. Comparatively, the wars in Iraq and Afghanistan are relatively cheap. Additionally, interest payments on our debt are up to 9%. Hopefully our next president will reign in federal spending and at least try to balance the budget.

- Lay the groundwork for energy sustainability and independence. I think everyone knows that we need to find new sources of energy that are cheap, abundant/renewable, clean, and produced at home so that the cost of energy doesn’t hamper economic growth, so we don’t destroy the planet, and so we can be less involved in the affairs of the ever-unstable Middle East.

- Reduce income disparities. Note that this is NOT equivalent to income redistribution. Greenspan says that there are two reasons why there is a growing wage gap in the U.S. which leads to social unrest and politicians touting populist economic policies. One reason is that skilled workers are overpaid on the high end because there is a shortage of them. We can reduce the shortage by loosening up immigration restrictions to make it easier for engineers, scientists, and doctors to come to work in the U.S. A larger supply of skilled workers will reduce the salaries commanded by those workers (perhaps much to my chagrin!) Additionally we can improve our education system so that we produce more skilled workers. A by-product of an improved education system is economic mobility on the low-end. If we can get more people educated and into high-skilled jobs, then there will be less people working in low-skilled jobs. Consequently, the people left in low-skilled jobs will probably be paid more because of the low supply of those workers.

Not surprisingly, neither Barack Obama or John McCain has released a substantial amount of detail about his economic policy. We’ll have to keep an eye out for more of that information.

July 27, 2008 5 Comments