My Social Network (Or Lack Thereof)

Most of my friends are right around the age of 30, and with the exception of swash, they’re just poor social networkers in general. Most of them do use facebook, but that’s where it stops. Some of them actually still refuse to use facebook out of sheer stubbornness, and just look down upon the whole social networking concept.

It’s actually a little bit frustrating when I have to email my friends if I find an interesting article, send the URL of a good site that I bookmarked, or send out a link to my latest flickr photo album. If we all used friendfreed, for example, they would just know when I uploaded new pictures to flickr, bookmarked a new site in del.icio.us, dugg a new article, updated my Netflix queue, etc.

A common argument I get into is that by sharing all this information, it actually gives people less to talk about when they see eachother. That somehow, having knowledge of what I’m reading, watching, or photographing ahead of time will detract from normal face-to-face conversation. I think that’s just bulls**t, and an easy way for people to justify a resistance to change or having to try something new. Similarly, there’s a wide belief that by spending too much time on social networking sites and the Internet in general, kids are losing their social skills. This belief is also quickly being debunked.

So if you’re around the age of 30, and not sure what this social networking phenomenon is all about, I urge you to give it a try. It will also be a much more rich experience if all your friends could do the same. But good luck getting them to join you.

December 23, 2008 4 Comments

Tom Ashbrook – Biased?

I listen to NPR almost every day, and I like the show On Point with Tom Ashbrook. There is usually a good discussion about current events, and there’s a minimum of commercials which is a trademark of NPR. However, Ashbrook’s coverage of the recent financial crisis has been biased in my opinion. He approaches the topic with the presumption that deregulation and capitalism running wild were the root causes of the whole mess, and that the economic experts of the world have reached a unanimous consensus that we need to have more, smarter regulations. It is as if the debate is over, if there ever was one.

As a further example, today Ashbrook had a guest on (I’m not sure who), and they were discussing Bernard Madoff, the investment firm manager who was recently charged with securities fraud which led to the collapse of his $50 billion dollar alleged Ponzi scheme. A caller told Ashbrook that he was an investment manager, and said that his biggest problems were the regulations. He was basically drowning in paperwork and legal overhead, and his business could be much more efficient if there were fewer regulations. Ashbrook replied (I’m paraphrasing from memory),

“Ha, what?! Less regulation?! That doesn’t really jive at all with what we’re seeing here caller!”

The caller continued to explain his point very well. He said that all firms have to be diligent in filing their paperwork, or else the SEC and other overseers will be on them. So they have a big incentive to do those things on time. But the problem is that while the government is checking that you filed your forms, nobody is checking to see whether you are telling the truth on those forms. There is really no way for anyone to know. Hence, everyone is burdened by the regulation overhead, but the liars still lie. I thought it was a really interesting point, but Ashbrook basically laughed him off the phone.

I think part of what happened in the Madoff case is that people believed that as a stock broker/dealer, he was operating under strict regulations, and that made them feel their investments were safe. After all, how can one commit fraud when there’s all that government oversight? Maybe the regulations created a moral hazard.

I guess you would say that Tom Ashbrook was defending a liberal position while I may be defending a conservative, or libertarian, or free-market position. And some may say that I shouldn’t be surprised that NPR is showing favoritism toward the liberal idea. Well, at least they don’t get any government funding.

December 17, 2008 10 Comments

A Simple Comparison

In 2007, General Motors and Toyota both sold the same number of automobiles, about 9.37 million each. But while Toyota’s net profit was about $14 billion, GM lost a jaw-dropping $39 billion. $39….b-b-b-billion! Many are asking the question – does GM need a government bailout, excuse me, a “bridge loan”, to keep it from failing? I disagree with the premise of this question – GM has already failed. Miserably.

December 13, 2008 1 Comment

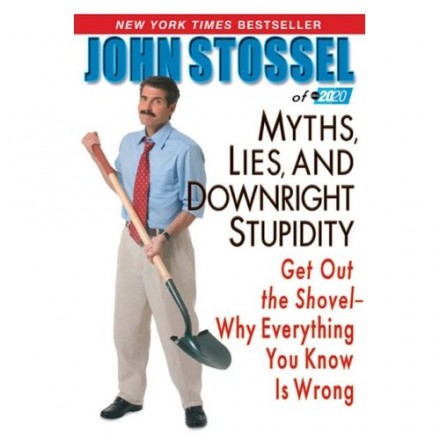

John Stossel

One of the best journalists around today is John Stossel. When I was a kid, my mom would come home from work late on Friday nights, and I used to stay up and watch 20/20 at 10 pm. At that time, Stossel was a consumer reporter/investigative journalist on the show and I used to enjoy watching his segments. He had a witty style and a dry sense of humor, and he just seemed to make a lot of practical sense, even though at that time I probably wasn’t paying attention to much other than sports and school. Now, Stossel co-hosts 20/20 with Elizabeth Vargas and also writes a column for TownHall.com.

He is also the author of the book Myths, Lies, and Downright Stupidity, which debunks the conventional wisdom regarding a wide range of topics including the health effects of chocolate, the price of gasoline, the safety of public schools, world overpopulaton, landfill space, etc. Stossel’s work generally supports a libertarian philosophy and a belief in free markets and small government, which is probably why he made so much sense to me when I was growing up!

December 10, 2008 6 Comments

Saving Health Care

From “Sick in America” with 20/20’s John Stossel.

Needless to say I am dead against Universal Health Care, and prefer something even more free-market than what we have today. The biggest problem with our health care system today is cost – how do we fix that? About a year ago, my employer introduced what is called a High Deductible Health Plan (HDHP) with a Health Savings Account (HSA). At first I thought it was highly annoying – I had to open a new account, save receipts, pay bills, pay attention to costs, etc. I used to have what I thought was a much simpler Health Maintenance Organization (HMO) plan. I didn’t have the freedom to go to any doctor – it had to be a doctor in “the network”, and I couldn’t go to a specialist without first being routed through my Primary Care Physician (PCP). What were the actual cost of my doctor visits? I had no idea. But it was simple. I would just pay the $25 co-pay and maybe get some confusing paperwork in the mail with a heading “This Is Not a Bill”, which meant it would go straight to the trash and out of my mind.

The fact that people don’t know how much medical procedures cost is a main reason why costs have been rapidly increasing. Doctors with patients who have full coverage plans have the incentive to charge patients whatever the system will allow. Insurance companies have the incentive to deny coverage for certain procedures to keep costs down. Highly educated doctors are reduced to low-level employees whose actions are effectively regulated by large corporations. With my new HDHP and my HSA I actually have to pay attention to what things cost, and I have the freedom to shop around. My company contributes to the HSA and I can put tax deductible money in there as well. I can use it to pay for doctor visits, contact lenses, medication, the dentist, and many more things. I have the incentive to look for the best possible treatment at the lowest possible cost, and websites are springing up to provide people with this information. And if something really bad happens, I am covered for anything that costs more than my deductible (about $2000). Yeah I have to keep track of a few more things, but I now feel that I am in control and I have more choices. This is how the system should work, and this is how our country can save health care.

November 29, 2008 4 Comments