Why I Didn’t Buy a House

When I started working a few years back, it didn’t take too long for friends, family, and co-workers to start pressuring me about buying a house (or condo). The most common remark was this: “By renting, you’re just throwing your money down the drain.” I had also read the book Rich Dad, Poor Dad by Robert Kiyosaki (before Kiyosaki turned into that creepy informercial guy peddling his wares on late-night TV. But, that really is a great book.) I did a little bit of due diligence, and it didn’t take me long to figure out that to buy even a tiny condo in the Boston area, I would have had to take out a huge mortgage. Here’s a quick example. A $300,000 mortage at 6% interest would make my monthly payments about $1800/month. As I’d get further into the mortgage, my payments toward principal would increase and payments toward interest would go down. My first payment would be $300 towards principal and $1500 toward interest! Even after 5 years into the mortgage, I would still be paying only $400 into principal, and $1400 into interest. How’s that for throwing money down the drain?

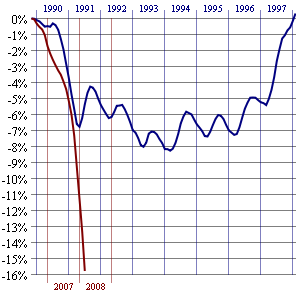

Comparison of the percentage change of the Case-Shiller Home Price Index for the housing correction beginning in 2005 (red) and the 1980s–1990s correction (blue), comparing monthly CSI values to the peak value seen just prior to the first declining month all the way through the downturn and the full recovery of home prices. Source: Wikipedia

Yeah you can deduct your interest payments from your taxes, so you recoup about a third of those interest payments. So the money I would pay towards interest in a mortgage wouldn’t be too far off from the $1000 in monthly rent that I pay. But as Robert Kiyosaki would say, buying a house or condo comes with a lot of non-obvious expenses – property taxes, maintenance, insurance – stuff you don’t have to worry about with an apartment.

Certainly, there are a lot of issues I have glossed over here. First of all it depends on where you live. If I could buy a nice place for $100k it would certainly be an easier decision. Also, it’s different if you’re buying investment property, or for example, a three-family house where you’ll live in one of the units, etc. Plus you just have to have the financial discipline to take the money you would have put into your mortgage payments and put that into an alternative investment. I’d suggest your 401k because up to $15,500 per year is tax-deductible, just like the mortgage interest payments. But in any case you should do your due diligence. I used Excel to make a detailed spreadsheet for my case but this website from the NY Times can help you with the math:

Now I’m not going to say that I predicted the severity of the housing bust, but in my humble opinion I did think prices were outrageous. And I’m certainly glad that I did my homework and decided not to buy a few years back. The same people that were pressuring me to buy then are now telling me how great of a time it is to buy. Maybe so, but I think those times will be here for a while, and my previous argument still holds. So the next time someone tells you that you’re throwing your money down the drain by renting, tell them to think again.

2 comments

I found your site on Google and read a few of your other entires. Nice Stuff. I’m looking forward to reading more from you.

[…] paying off your mortgage, or are a renter, please check it out. If you’re a renter, check out one blogger’s case for not buying a home, and have a look at the NYTimes’ Rent or Buy calculator (might require […]

Leave a Comment