The Housing Boom and Bust

I just finished reading Stanford economist Thomas Sowell‘s new book, The Housing Boom and Bust. It’s a really easy read, not too technical, but filled with a lot of good statistics. The thesis of the book can basically be summed up by the following paragraph:

In a complex story about intricate financial arrangements, it is possible to lose sight of a plain and fundamental fact – that behind all the esoteric securities and sophisticated financial dealings are simple, monthly mortgage payments from millions of home buyers across the country. When many of those payments stop coming, no amount of financial expertise in Wall Street or government regulatory intervention from Washington can save the whole investment structure built up on the foundation of those mortgage payments.

The bedrock question then is: Why did so many monthly mortgage payments stop coming? And the bedrock answer is: Because mortgage loans were made to more people whose prospects of repaying them were less than in the past. Nor was this simply a matter of misjudgment by banks and other lenders. The political pressures to meet arbitrary lending quotas, set by officials with the power of economic life and death over banks and over Fannie Mae and Freddie Mac, led to riskier lending practices than in the past.”

I wish Sowell wrote more about the effect of credit default swaps and other complex financial derivatives, but he pretty much dismisses those as “downstream effects”, while the real cause of the crisis was that people were living in homes they couldn’t afford, due to the political pressures on banks and regulators to lend or allow lending to those people, in the name of “affordable housing”.

Sowell also raises an interesting argument that I haven’t heard before. He says that the boom in real estate prices was really a local issue, and that most communities across the country did not see prices rise much more than inflation and incomes. In localities such as coastal California, Miami, Phoenix, Las Vegas, etc. land use restrictions were put in place to limit the land available for building homes. For example, in bubble areas such as San Mateo County in California, more than half of all land is designated as “open space” and cannot be developed. In places like Houston and Dallas, which have no such restrictions and which have seen incomes rise faster than the national average, there was no housing bubble. He argues that such land use restrictions are often put in place by wealthy elites in the name of environmental friendliness, smart planning, or protecting the community from urban sprawl. It has the secondary effect of artificially raising the home values for the people that already live in the community. Furthermore, he argues that these restrictions are unconstitutional, as it allows people to restrict building on land (the “open spaces”) that they do not own.

Sowell also leaves us with this discouraging statement regarding President Obama and his various economic interventions:

Whatever its shortcomings economically, what government job creation programs can do politically is create a large class of people beholden to the government and likely to vote for those who gave them jobs in hard times. The political success of the New Deal is beyond dispute. That FDR could be re-elected in a landslide in 1936 and re-elected again to an unprecedented third term in 1940, despite never having gotten unemployment down into single digits during his first two terms, is a sign that President Obama may also be able to succeed politically, even if his policies turn out to be an economic disaster for the country as a whole.”

🙁

June 7, 2009 4 Comments

The Case for Doing Nothing

Harvard economist Jeffrey Miron on how your government effed it all up and how it is continuing to eff it up:

April 30, 2009 No Comments

Why I Didn’t Buy a House

When I started working a few years back, it didn’t take too long for friends, family, and co-workers to start pressuring me about buying a house (or condo). The most common remark was this: “By renting, you’re just throwing your money down the drain.” I had also read the book Rich Dad, Poor Dad by Robert Kiyosaki (before Kiyosaki turned into that creepy informercial guy peddling his wares on late-night TV. But, that really is a great book.) I did a little bit of due diligence, and it didn’t take me long to figure out that to buy even a tiny condo in the Boston area, I would have had to take out a huge mortgage. Here’s a quick example. A $300,000 mortage at 6% interest would make my monthly payments about $1800/month. As I’d get further into the mortgage, my payments toward principal would increase and payments toward interest would go down. My first payment would be $300 towards principal and $1500 toward interest! Even after 5 years into the mortgage, I would still be paying only $400 into principal, and $1400 into interest. How’s that for throwing money down the drain?

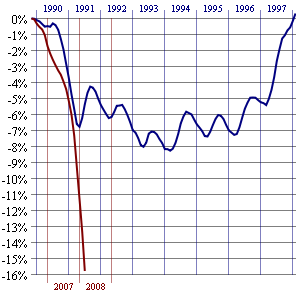

Comparison of the percentage change of the Case-Shiller Home Price Index for the housing correction beginning in 2005 (red) and the 1980s–1990s correction (blue), comparing monthly CSI values to the peak value seen just prior to the first declining month all the way through the downturn and the full recovery of home prices. Source: Wikipedia

Yeah you can deduct your interest payments from your taxes, so you recoup about a third of those interest payments. So the money I would pay towards interest in a mortgage wouldn’t be too far off from the $1000 in monthly rent that I pay. But as Robert Kiyosaki would say, buying a house or condo comes with a lot of non-obvious expenses – property taxes, maintenance, insurance – stuff you don’t have to worry about with an apartment.

Certainly, there are a lot of issues I have glossed over here. First of all it depends on where you live. If I could buy a nice place for $100k it would certainly be an easier decision. Also, it’s different if you’re buying investment property, or for example, a three-family house where you’ll live in one of the units, etc. Plus you just have to have the financial discipline to take the money you would have put into your mortgage payments and put that into an alternative investment. I’d suggest your 401k because up to $15,500 per year is tax-deductible, just like the mortgage interest payments. But in any case you should do your due diligence. I used Excel to make a detailed spreadsheet for my case but this website from the NY Times can help you with the math:

Now I’m not going to say that I predicted the severity of the housing bust, but in my humble opinion I did think prices were outrageous. And I’m certainly glad that I did my homework and decided not to buy a few years back. The same people that were pressuring me to buy then are now telling me how great of a time it is to buy. Maybe so, but I think those times will be here for a while, and my previous argument still holds. So the next time someone tells you that you’re throwing your money down the drain by renting, tell them to think again.

July 31, 2008 2 Comments