Reading List for the Current Financial Crisis

Over the last couple of weeks, I have been captivated by the happenings on Wall Street. It truly does seem like a critical time for our great nation, and one can only hope that the people handling this crisis will make the right decisions. I do feel that we’re in good hands, because Treasury Secretary Henry Paulson and Federal Reserve Chairman Ben Bernanke are well-respected across the board and are by all accounts two of the smartest people in the financial world. I think we all just have to trust them. It’s going to be hard for me or anyone to second-guess those guys in 5-10 years, because most economists say there is nothing close to a historical precedent for the current crisis. In any case, I wish I had a more formal education in finance and economics, so I could better understand what’s going on. But I don’t, so I’ve just been reading as much as I possibly can. Here are the best articles I have run across, in no particular order:

- Freddie Mac and Fannie Mae: An Exit Strategy for the Taxpayer – from the Libertarian think tank the Cato Institute; includes a timeline of the history of Fannie Mae and Freddie Mac.

- AIG’s Troubles and Why They Matter – New York Times Illustration.

- New Agency Proposed to Oversee Freddie Mac and Fannie Mae – from Stephen Labaton at the New York Times. Notice that this article was written five years ago – of course the proposal never came to fruition.

- Who Is To Blame For The Subprime Crisis? – from Investopedia.

- The Social Imperative of Sound Money – opinion piece from the Ludwing von Mises Institute, a Libertarian academic organization; it is a bit critical of Henry Paulson.

- Seven Deadly Sins of Deregulation — and Three Necessary Reforms – opinion piece by Robert Kuttner, a liberal economist. Though I don’t agree with his stance on this issue, it’s important to include an opposing viewpoint.

September 17, 2008 1 Comment

When Less is More

In the wake of the collapse of Lehman Brothers and Merrill Lynch, both presidential candidates are calling for tighter regulation of the U.S. financial markets. That might make for good soundbites, but it’s more important to look back at the root cause of today’s troubles.

Under Presidents Bill Clinton and George W. Bush, the government heavily promoted home ownership to all citizens, even those with lower incomes and weak credit. Fannie Mae and Freddie Mac bought these loans from the primary lenders (banks) because they offered the highest rate of return, and coincidentally, the most risk. Fannie and Freddie casually assumed those risks, because the two companies were effectively guaranteed by the federal government, i.e., the taxpayer.

Whose idea was it to create Fannie Mae? It was part of Franklin Roosevelt’s New Deal administration. Who’s idea was it to make Fannie Mae a private corporation with implicit government backing? It was Lyndon Johnson’s (Freddie Mac was created in 1970 during Richard Nixon’s administration to provide some competition to Fannie Mae). Whose jobs were to make sure that Fannie and Freddie were able to handle these high-risk mortgages? The regulators. Why didn’t the regulators do their jobs? It might be that the incentive for someone to do his/her job as a regulator is much less than the incentive for someone else to try to make millions of dollars. The end result is that the seeds sown by the government years ago probably set the stage for the takedown of two huge financial companies, and possibly more to come.

I think what we can learn from all this is that when the government intervenes in the free market, any short-term benefit will likely be counteracted by an unforeseen catastrophe in the long-term. What’s happening now is probably a much needed correction in the financial markets that will be necessary for long-term economic health. Hopefully, the government doesn’t throw too many wrenches in the works during the meantime.

September 15, 2008 No Comments

Why Social Security Sucks

Social Security seems like a good idea. You put some money into the system now and you get to take that money out when you retire, right? It’s called a tax, but it’s not really since you get that money back, right? It’s nice to have that big security blanket when you retire, isn’t it?

To me, it sounds too good to be true, so I decided to put some hypothetical numbers down in a spreadsheet. Take a look at it, and put in your own numbers. To calculate your Social Security benefits, you can either go to the estimator on the Social Security Website, or use this quicker one.

Right now, 12.4% of every working person’s paycheck goes to Social Security. That includes 6.2% taken directly out of your paycheck, and another 6.2% that is matched by your employer. So for my spreadsheet, I wanted to figure out how much money I could make if I could invest that 12.4% of my paycheck privately, rather than having the federal government take it. I assumed that I made $50,000 starting out of school at age 24, and would retire at age 65. I assumed my income would grow slightly faster than inflation (4% vs. 3.1%), and that I could invest that Social Security money at a 6% rate of return, which I think is fairly conservative. Change up the numbers if you like.

The results are astonishing. Without Social Security, at the age of 65 I would have about $2 million in my investment account, whereas with Social Security, I would start getting back $59,677 per year from the government. The government money does goes up with inflation every year. But even if I took that $59,677 (inflation-adjusted) out of my investment account every year, I would never run out of money. The investment account would actually grow each year by more than the Social Security benefit. By the age of 80 I would have almost $2.8 million in the account!

Social Security helped lift millions of the elderly out of poverty in the 1930s and the decades beyond. But the original tax rate was only 2% (1% each on the employer and employee). Since then it has ballooned to a whopping 12.4%. Instead of handing that money over to the federal government so they can waste it, I’d rather hold on to it – to do with as I please.

September 8, 2008 5 Comments

Could Obama Pick a Republican?

Source: Barack Obama on Flickr

It’s rumored that Barack Obama will announce his running mate within the week. According to the Intrade Prediction Market, the leading contender is Joe Biden, the senior Senator from Delaware. A contract for Joe Biden as the Democratic Vice Presidential nominee is currently trading at 30.90 (for those not familiar with prediction markets, that number is essentially the probability in percentage terms, set by the market, that Joe Biden will be the nominee). But I don’t actually like Biden for the job. According to the National Journal 2007 Vote Ratings, he is the third-most liberal Senator in the country. Barack Obama tops the list as the most liberal Senator. I think by choosing Biden as his running mate, Obama will reinforce his liberal voting record, which will make it hard for him to run as a centrist and capture a substantial portion of independent voters.

If Obama really wants to change the politics in Washington, he should seriously consider picking a Republican as his running mate. I believe that the most compelling case can be made for Chuck Hagel, the senior Senator from Nebraska (an Intrade contract for Hagel is currently trading at 5.10). Hagel is apparently a good friend of Obama, and he has been mentioned as a likely cabinet member in an Obama administration. Hagel worked on Ronald Reagan’s campaign for California governor, and served in the Reagan administration as the Deputy Administrator of Veteran Affairs. He is a Vietnam War Veteran, Purple Heart receipient, and a very successful businessman. He has served on the Senate Committee on Foreign Relations, and the Committee on Banking, Housing, and Urban Affairs. He has been highly critical of the Bush administration and its handling of the Iraq war, and he supports a timetable for U.S. troop withdrawal. He is also known for working with Democrats in the Senate, as he did with Ted Kennedy on the Immigration Reform Act of 2007. Of course, Hagel is a conservative and has large differences with Obama when it comes to social litmus test issues such as abortion, affirmative action, and the death penalty. Maybe it’s a long shot, but if Barack Obama wants to solve some of our country’s real problems over the next four years or more, he needs to look past those issues. Choosing a Republican as his running mate, especially Chuck Hagel, will signify to Americans that he is not your typical liberal Democratic candidate, and that he is truly serious about reaching across the aisle to get things done.

August 18, 2008 3 Comments

A World Record Embarrassment

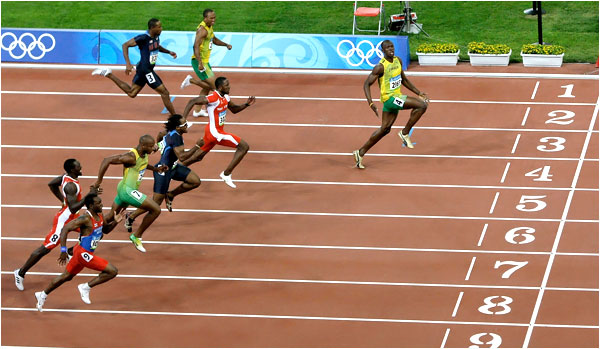

Photo: Matt Dunham/Associated Press

I had just finished watching Michael Phelps make history by winning his record eighth gold medal of these Olympics. It was a moment that gave me and millions of people around the world goosebumps. It was a moment that I will be able to tell my kids about years from now. Phelps was part of the 4×100-meter medley relay team, which was anchored by Jason Lezak. Lezak was able to hold off Australian Eamon Sullivan as the two swam hard right to the finish, right to the finish. It was an awesome race – one that embodied all that is good about the Olympics. I found myself briefly reflecting on how superb these Games have been so far.

Up next on the NBC broadcast was the much-anticipated 100-meter final. It was tape-delayed, and though I tried to avoid hearing who won, I found out earlier in the day that it was the Jamaican Usain Bolt. NBC showed an interview with Bolt, and he seemed like a humble enough guy, proud to be representing his country in Beijing.

After the gun sounded, Bolt surged out to an early lead, and within a few seconds it was clear that he was going to win, and probably set a new world record. What I saw next was shocking. When Bolt realized he had a big lead, he put his hands out, and then pounded his chest, while slowing down deliberately before crossing the finish line.

Bolt won the gold and broke his own world record, clocking in at 9.69 seconds. But it was a total sham – an embarassment to the sport and to the Olympics. I was furious that this chest-thumping showboater was going to be all over the news in the coming days, reaffirmed as “the fastest man in the world.” I could think of something else to call him. A friend of mine said to the television in disgust, “All that is asked of you, Usain Bolt, is about 9.7 seconds of effort.” Bolt disrespected his country and his competitors, two of whom were fellow Jamaicans. I hope the sports media and the blogosphere tear him apart, and I hope this selfish act turns out to be just an isolated occurrence in what has otherwise been the best Olympics in recent memory.

August 16, 2008 4 Comments